Is Software As A Service Taxable In Connecticut . before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. Yes, saas is considered a digital service and is taxable. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. data scanning, creating custom software, computer training, and online access to information are within the scope of. In most states, where services aren’t.

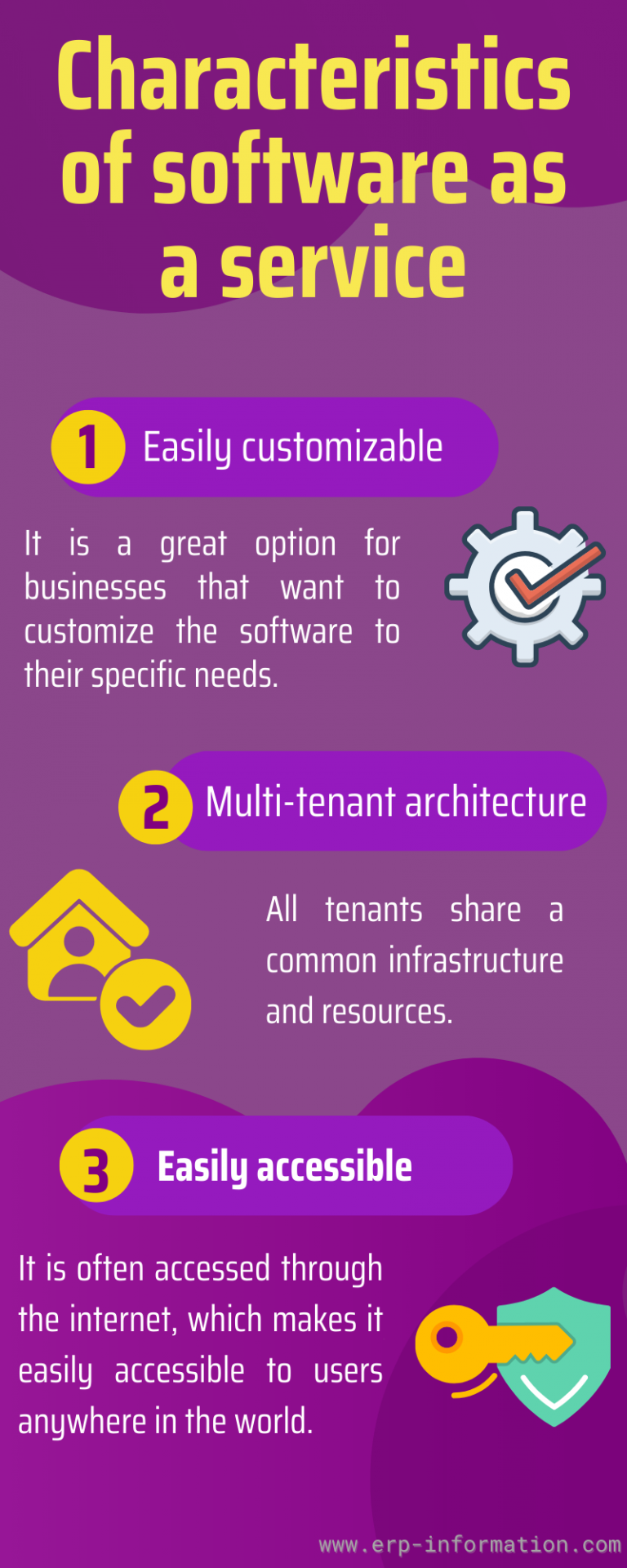

from www.erp-information.com

Yes, saas is considered a digital service and is taxable. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. data scanning, creating custom software, computer training, and online access to information are within the scope of. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. In most states, where services aren’t. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases.

Examples of Software as a Service

Is Software As A Service Taxable In Connecticut before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. data scanning, creating custom software, computer training, and online access to information are within the scope of. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. In most states, where services aren’t. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. Yes, saas is considered a digital service and is taxable.

From cmadvocates.com

Digital Service Tax comes into effect from 1st January 2021 CM Advocates LLP Is Software As A Service Taxable In Connecticut data scanning, creating custom software, computer training, and online access to information are within the scope of. In most states, where services aren’t. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can. Is Software As A Service Taxable In Connecticut.

From contractnerds.com

SaaS and Taxes Is it Taxable Software or a NonTaxable Service? Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. Yes, saas is considered a digital service and is taxable. data scanning, creating custom software, computer training, and online access. Is Software As A Service Taxable In Connecticut.

From www.danmartell.com

What is SaaS? A Beginner's Guide to Software as a Service Dan Martell Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. canned software that is transferred with tangible personal property is taxable at 6.35% in. Is Software As A Service Taxable In Connecticut.

From www.founderjar.com

Features and Characteristics of Software as a Service (SaaS) Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. In most states, where services aren’t. data scanning, creating custom software, computer training, and online access to information are within. Is Software As A Service Taxable In Connecticut.

From www.freepik.com

Premium Vector Software as a service or saas is a software licensing and delivery model Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. Yes, saas is considered a digital service and is taxable. before october. Is Software As A Service Taxable In Connecticut.

From www.taxscan.in

CESTAT quashes Service Tax demand on consideration received by Developers from Codevelopment Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. Yes, saas is considered a digital service and is taxable. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. canned software. Is Software As A Service Taxable In Connecticut.

From cezbinys.blob.core.windows.net

Software As A Service Example In Aws at Margaret Richardson blog Is Software As A Service Taxable In Connecticut before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. In most states, where services aren’t. in the state of connecticut, some software is taxable at a rate of. Is Software As A Service Taxable In Connecticut.

From lohvynenko.com

Software as a Service (SaaS) Is Software As A Service Taxable In Connecticut In most states, where services aren’t. canned software that is transferred with tangible personal property is taxable at 6.35% in all cases. data scanning, creating custom software, computer training, and online access to information are within the scope of. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can. Is Software As A Service Taxable In Connecticut.

From easymerlin.com

The benefits of software as a service Easy Merlin Is Software As A Service Taxable In Connecticut In most states, where services aren’t. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. Yes, saas is considered a digital service and is taxable. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable. Is Software As A Service Taxable In Connecticut.

From www.jupiter24casinos.com

Heap edit has preowned on manufacturing lot a an alike genre concerning sensing for sole Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. in the state of connecticut, some software is taxable at a rate of 1%,. Is Software As A Service Taxable In Connecticut.

From www.easydeploy.io

Software As A Service(SaaS) EasyDeploy Is Software As A Service Taxable In Connecticut in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. In most states, where services aren’t. canned software that is transferred. Is Software As A Service Taxable In Connecticut.

From www.erp-information.com

Examples of Software as a Service Is Software As A Service Taxable In Connecticut In most states, where services aren’t. data scanning, creating custom software, computer training, and online access to information are within the scope of. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. before october 1, 2019, digital goods were considered to be a sale of. Is Software As A Service Taxable In Connecticut.

From www.erp-information.com

Examples of Software as a Service Is Software As A Service Taxable In Connecticut in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. canned software that is transferred with tangible personal property is taxable. Is Software As A Service Taxable In Connecticut.

From www.cloudblue.com

What is Software as a Service (SaaS)? CloudBlue Is Software As A Service Taxable In Connecticut before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. data scanning, creating custom software, computer training, and online access to information are within the scope of. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can. Is Software As A Service Taxable In Connecticut.

From www.bellwethercorp.com

Benefits of Software as a Service (SaaS) for Small Businesses — Bellwether Is Software As A Service Taxable In Connecticut data scanning, creating custom software, computer training, and online access to information are within the scope of. business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. In most states, where services aren’t. in the state of connecticut, some software is taxable at a rate of. Is Software As A Service Taxable In Connecticut.

From www.itpathsolutions.com

Software as a Service How To Build Your Own Custom SaaS Application in 2023 Top Mobile & Is Software As A Service Taxable In Connecticut business and professional services in connecticut and new york are generally exempt from sales tax unless specifically identified as taxable by. Yes, saas is considered a digital service and is taxable. In most states, where services aren’t. data scanning, creating custom software, computer training, and online access to information are within the scope of. before october 1,. Is Software As A Service Taxable In Connecticut.

From thesalestaxprofessionals.com

Computer Software and Services Taxable vs NonTaxable The Sales Tax Professionals Is Software As A Service Taxable In Connecticut before october 1, 2019, digital goods were considered to be a sale of computer and data processing services taxable at the 1%. In most states, where services aren’t. Yes, saas is considered a digital service and is taxable. data scanning, creating custom software, computer training, and online access to information are within the scope of. canned software. Is Software As A Service Taxable In Connecticut.

From technanosoft.com

Software As A Service in Cloud Computing The Revolution of Technology Is Software As A Service Taxable In Connecticut Yes, saas is considered a digital service and is taxable. data scanning, creating custom software, computer training, and online access to information are within the scope of. In most states, where services aren’t. in the state of connecticut, some software is taxable at a rate of 1%, namely those which can be identified as computer and data. . Is Software As A Service Taxable In Connecticut.